SOUTHGOBI RESOURCES LTD. (:1878) SouthGobi Announces Fourth Quarter and Full Year 2021 Unaudited Financial and Operating Results and Postpones Filing Of 2021 Audited Consolidated Financial Statements and Annual Filings

Transparency directive : regulatory news

HONG KONG, CHINA / ACCESSWIRE / March 30, 2022 / SouthGobi Resources Ltd. (Toronto Stock Exchange ("TSX"): SGQ, Hong Kong Stock Exchange ("HKEX"): 1878) (the "Company" or "SouthGobi") today announces its unaudited financial and operating results for the quarter and the year ended December 31, 2021. All figures are in U.S. dollars ("USD") unless otherwise stated.

This announcement is made by the Company pursuant to Rule 13.09(2) of the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange (the "Hong Kong Listing Rules") and the Inside Information Provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong).

Reference is made to the announcement of the Company dated March 11 and 24, 2022 (the "Announcements"). As disclosed in the Announcements, the Company has been advised by the Company auditors (the "Auditors") that they will not be in a position to render an unmodified opinion on the Company's 2021 financial statements prior to the filing deadline of March 31, 2022 because they have not been able to obtain sufficient evidence to support management's going concern assumptions. Accordingly, the Company cautions that the financial results for its financial year ended December 31, 2021 disclosed herein are unaudited and have not been agreed upon with the Auditors. The unaudited financial results of the Company for the financial year ended December 31, 2021 disclosed herein were reviewed by the Audit Committee of the Company and approved and authorized for issue by the Board on March 30, 2022.

The Company is postponing the filing of its audited consolidated financial statements for its financial year ended December 31, 2021, the accompanying Management's Discussion and Analysis of Financial Condition and Results of Operation ("MD&A") and its Annual Information Form for the financial year ended December 31, 2021 (collectively, the "2021 Annual Filings"), as a result of the Auditors being unable to complete the audit process for the Company's annual results for the year ended 2021 prior to the filing deadline for the 2021 Annual Filings.

On March 17, 2022, the Company made an application to the British Columbia Securities Commission ("BCSC"), the Company's principal securities regulator in Canada, requesting that a management cease trade order (a "MCTO") be granted in respect of the late filing of the 2021 Annual Filings. As of the date hereof, the BCSC has not issued a decision in respect of the Company's MCTO application. There is no guarantee that a MCTO will be granted. For more information on the potential outcome of the BCSC's decision to either grant or refuse to grant the MCTO, see "Management Cease Trade Order" below.

Until such time as the Company files its 2021 Annual Filings, shareholders and potential investors of the Company are advised to exercise caution when dealing in the securities of the Company.

Significant Events and Highlights

The Company's significant events and highlights for the year ended December 31, 2021 and the subsequent period to March 30, 2022 are as follows:

- Operating Results - In response to the increase in COVID-19 case numbers in Mongolia, the Chinese authorities has been restricting the number of trucks permitted to cross the Ceke Port of Entry, and such restriction has severely impacted the sales volume of the Company in the third and fourth quarters of 2021. As a result, the Company's sales volume decreased from 2.6 million tonnes in 2020 to 0.9 million tonnes in 2021.

In response to the restrictions on the number of trucks crossing the Mongolian border into China which began as of the second quarter of 2021, the Company temporarily suspended its major mining operations (including coal mining) in the second quarter of 2021 in order to control the inventory level and preserve the Company's working capital. Mining operations (including coal mining) resumed in the third quarter of 2021. However, mining operations were temporarily suspended again by the Company beginning in November 2021 in response to the temporary closure of the Ceke Port of Entry in the fourth quarter of 2021. See "Impact of the COVID-19 Pandemic" below.

The Company experienced an increase in the average selling price of coal from $35.5 per tonne in the fourth quarter of 2020 to $55.4 per tonne in the fourth quarter of 2021, as a result of improved market conditions in China and an improvement of the overall product mix.

- Financial Results - The Company recorded a $4.4 million profit from operations in 2021 compared to a $15.3 million profit in 2020. The financial results were impacted by the decreased sales resulting from the export volume limitations as well as the closure of the Ceke Port of Entry experienced by the Company during the year.

- Impact of the COVID-19 Pandemic - Since the second quarter of 2021, additional precautionary measures were imposed by the Chinese authorities at the Ceke Port of Entry in response to the increase of COVID-19 cases in Mongolia, which included restricting the number of trucks crossing the Mongolian border into China. The restrictions on trucking volume have had an adverse impact on the Company's ability to import its coal products into China in 2021.

In response to the increase in the number of COVID-19 cases in Ejinaqi, a region in China's Inner Mongolia Autonomous Region where the custom and border crossing are located, reported in late October 2021, the local government authorities have imposed stringent preventive measures throughout the region, including the temporary closure of the Ceke Port of Entry located at the border of Mongolia and China. Accordingly, the Company's coal exports into China have been suspended and such suspension remains in effect as of the date hereof. The Company anticipates the temporary closure of the Ceke Port of Entry will have a material adverse impact on the Company's sales and cash flow until such time as coal exports into China are allowed to resume. In order to control the inventory level and preserve the Company's working capital, the Company temporarily suspended mining operations (including coal mining) beginning in early November 2021.

The Company will continue to closely monitor the COVID-19 pandemic and the impact it has on coal exports to China and will continue to react promptly to preserve the working capital of the Company and mitigate any negative impacts on the business and operations of the Company.

In the event that the Company's ability to export coal into the Chinese market continues to be restricted or limited, this is expected to have a material adverse effect on the business and operations of the Company and may negatively affect the price and volatility of the Common Shares and any investment in such shares could suffer a significant decline or total loss in value.

- China Investment Corporation ("CIC") Convertible Debenture ("CIC Convertible Debenture") - On July 30, 2021, the Company and CIC entered into an agreement (the "2021 July Deferral Agreement") pursuant to which CIC agreed to grant the Company a deferral of: (i) semi-annual cash interest payments of $8.1 million payable to CIC on November 19, 2021; and (ii) $4.0 million worth of payment in kind interest ("PIK Interest") shares (collectively, the "2021 Deferral Amounts") issuable to CIC on November 19, 2021 under the CIC Convertible Debenture.

The principal terms of the 2021 July Deferral Agreement are as follows:

- Payment of the 2021 Deferral Amounts will be deferred until August 31, 2023.

- As consideration for the deferral of the 2021 Deferral Amounts, the Company agreed to pay CIC a deferral fee equal to 6.4% per annum on the 2021 Deferral Amounts payable under the CIC Convertible Debenture, commencing on November 19, 2021.

- Management Cease Trade Order - On March 17, 2022, the Company made an application to the BCSC under National Policy 12-203 of the Canadian Securities Administrators ("NP 12-203") requesting that a MCTO be granted in respect of the late filing of the 2021 Annual Filings. As of the date hereof, the BCSC has not issued a decision in respect of the Company's MCTO application. There is no guarantee that a MCTO will be granted.

If a MCTO is granted, the Company will attempt to obtain and provide to the Auditors sufficient evidence to support management's going concern assumptions, and will attempt to obtain an unmodified opinion from the Auditors on the 2021 Financial Statements prior to the expiry of the MCTO. While the MCTO is in effect, the Company's Chief Executive Officer and Chief Financial Officer will be and, subject to the BCSC's discretion, the Company's other senior officers, directors and insiders may be, restricted from trading in the Company's securities. The Company will be required to comply with the provisions of the alternative information guidelines as set out in NP 12-203 for so long as the MCTO remains in effect, including the issuance of bi-weekly de-fault status reports by way of press releases. If a MCTO is granted, the MCTO would not affect the ability of investors who are not directors, officers and insiders to trade in the securities of the Company on the TSX and the HKEX.

However, if a MCTO is not granted, it is anticipated that the BCSC will issue a general "failure to file" cease trade order ("CTO") shortly after the filing deadline of March 31, 2022 prohibiting the trading by any person of any securities of the Company in Canada, including trades in the Company's common shares made through the TSX. The CTO will remain in place until such time as the 2021 Annual Filings are filed by the Company.

As a result of CTO, the Company anticipates that the trading in the Company's common shares will be halted on the TSX, and the trading in the common shares of the Company on the HKEX will also be suspended until such time as the CTO is lifted and trading resumes on the TSX.

The issuance of a CTO would have a significant adverse impact on the liquidity of the Company's common shares and shareholders may suffer a significant decline or total loss in value of its investment in the Company's common shares as a result.

- Changes in Management

Mr. Weiguo Zhang: Mr. Zhang resigned as Chief Financial Officer on February 10, 2021.

Mr. Alan Ho: Mr. Ho was appointed as acting Chief Financial Officer on February 10, 2021.

Mr. Aiming Guo: Mr. Guo resigned as Chief Operating Officer on February 10, 2021.

Mr. Tao Zhang: Mr. Zhang has been re-designated from Vice President to Vice President of Sales on February 10, 2021.

Mr. Munkhbat Chuluun: Mr. Chuluun was appointed as Vice President of Public Relations on February 10, 2021.

- Going Concern - Several adverse conditions and material uncertainties relating to the Company cast significant doubt upon the going concern assumption which includes the deficiencies in assets and working capital.

See section "Liquidity and Capital Resources" of this press release for details.

OVERVIEW OF OPERATIONAL DATA AND FINANCIAL RESULTS

Summary of Annual Operational Data

The Company cautions that the financial results for its financial year ended December 31, 2021 set forth below are unaudited and have not been agreed upon with the Auditors.

(i) A Non-International Financial Reporting Standards ("non-IFRS") financial measure. Refer to "Non-IFRS Financial Measures" section. Cash costs of product sold exclude idled mine asset cash costs.

(ii) Per 200,000 man hours and calculated based on a rolling 12-month average.

Overview of Annual Operational Data

The Company ended 2021 without a lost time injury. As at December 31, 2020, the Company had a lost time injury frequency rate of 0.03 per 200,000 man hours based on a rolling 12-month average.

The Company sold 0.9 million tonnes in 2021 as compared to 2.6 million tonnes in 2020. The average selling price increased from $33.0 per tonne for 2020 to $46.0 per tonne for 2021, as a result of improved market conditions in China and an improvement of the overall product mix.

The product mix for 2021 consisted of approximately 64% of premium semi-soft coking coal, 34% of standard semi-soft coking coal/premium thermal coal and 2% of washed coal compared to approximately 39% of premium semi-soft coking coal, 54% of standard semi-soft coking coal/premium thermal coal and 7% of washed coal in 2020.

The Company's production in 2021 was lower than 2020 as a result of the Company's major mining operations (including coal mining) being temporarily suspended for a relatively longer period in 2021 in order to mitigate the financial impact of the border closures and to preserve the Company's working capital, yielding 1.4 million tonnes for 2021 as compared to 1.5 million tonnes for 2020.

The Company's unit cost of sales of product sold increased from $22.3 per tonne in 2020 to $33.3 per tonne in 2021. The increase was mainly driven by the increase in the effective royalty rate.

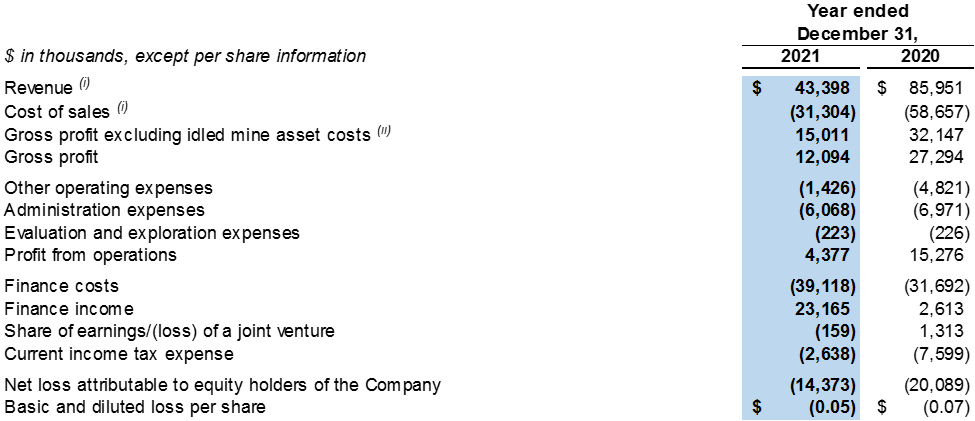

Summary of Annual Financial Results

- Revenue and cost of sales relate to the Company's Ovoot Tolgoi Mine within the Coal Division operating segment. Refer to note 4 of the consolidated financial statements for further analysis regarding the Company's reportable operating segments.

- A Non-IFRS financial measure. Refer to "Non-IFRS Financial Measures" section. Idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

Overview of Annual Financial Results

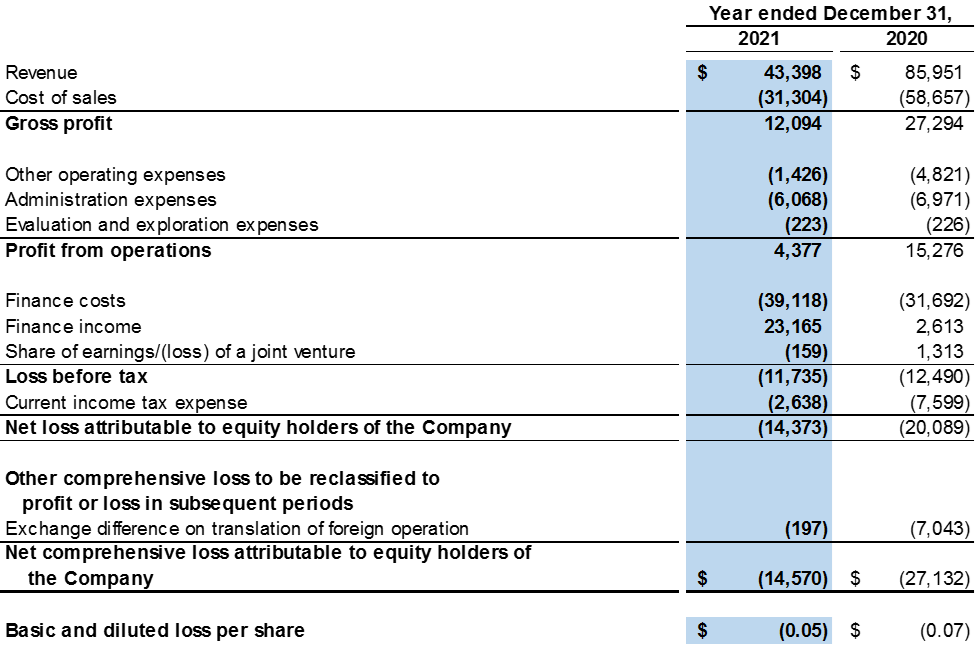

The Company recorded a $4.4 million profit from operations in 2021 compared to a $15.3 million profit in 2020. The financial results were impacted by (i) the export volume limitations experienced by the Company during the year and (ii) the closure of the Mongolia-China border which resulted in the Company being unable to export its coal products to China during the fourth quarter of 2021.

Revenue was $43.4 million in 2021 compared to $86.0 million in 2020. The Company's effective royalty rate for 2021, based on the Company's average realized selling price of $46.0 per tonne, was 18.7% or $8.6 per tonne, compared to 12.2% or $4.0 per tonne in 2020 (based on the average realized selling price of $33.0 per tonne).

Royalty regime in Mongolia

On June 23, 2021, the Government of Mongolia issued a new resolution in connection with the royalty regime. From July 1, 2021 onwards, the royalty payable is to be calculated based on the reference price as determined by the Government of Mongolia, and the reference to the contract sales price will be removed.

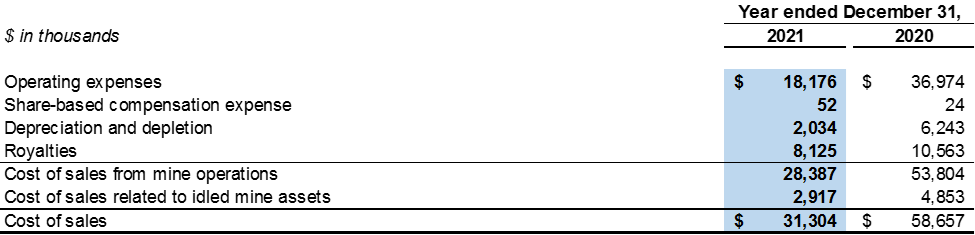

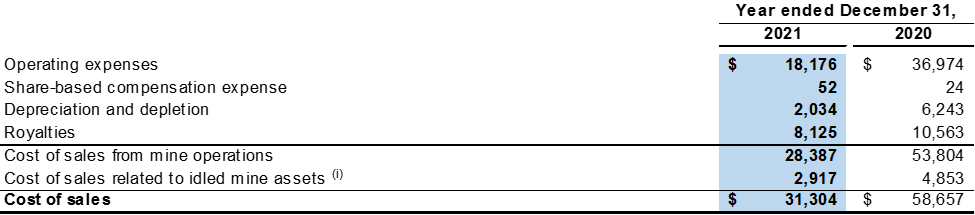

Cost of sales was $31.3 million in 2021 compared to $58.7 million in 2020. The decrease in cost of sales in 2021 was mainly due to the effect of decreased sales volume. Cost of sales consists of operating expenses, share-based compensation expense, equipment depreciation, depletion of mineral properties, royalties and idled mine asset costs. Operating expenses in cost of sales reflect the total cash costs of product sold (a Non-IFRS financial measure, refer to section "Non-IFRS Financial Measures" for further analysis) during the year.

Operating expenses in cost of sales were $18.2 million in 2021 compared to $37.0 million in 2020. The overall decrease in operating expenses was primarily due to the decreased sales volume from 2.6 million tonnes in 2020 to 0.9 million tonnes in 2021.

Cost of sales related to idled mine assets in 2021 included $2.9 million related to depreciation expenses for idled equipment (2020: $4.9 million).

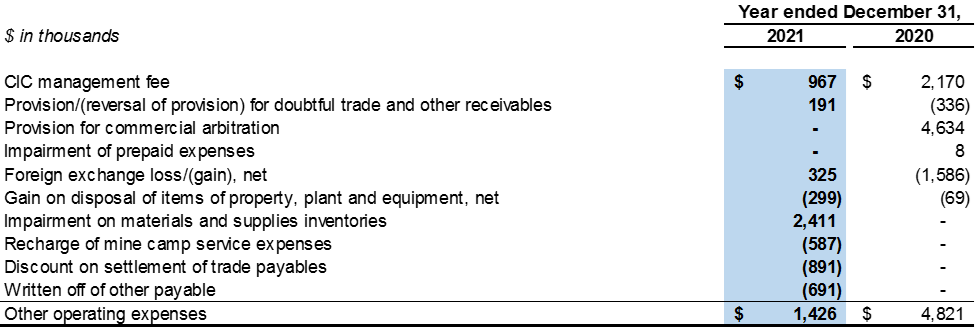

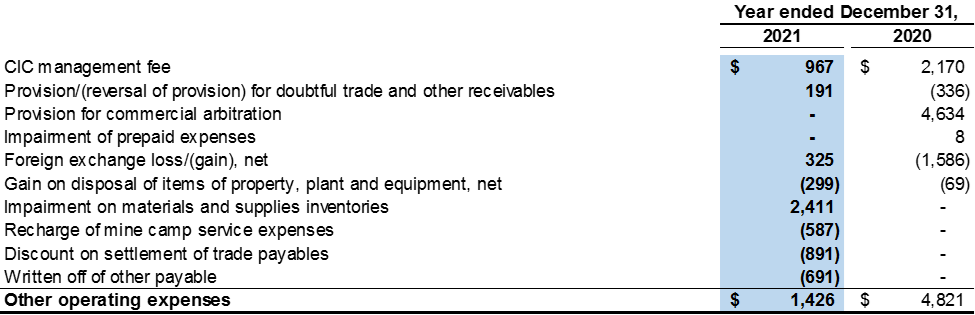

Other operating expenses were $1.4 million in 2021 (2020: $4.8 million), which mainly comprises of the impairment of materials and supplies inventories of $2.4 million in 2021.

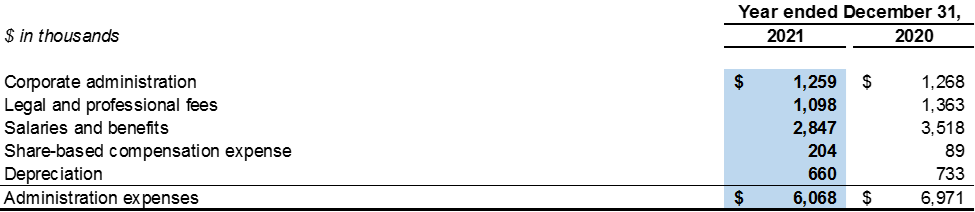

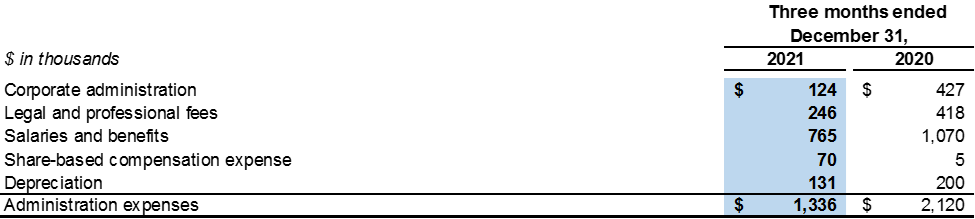

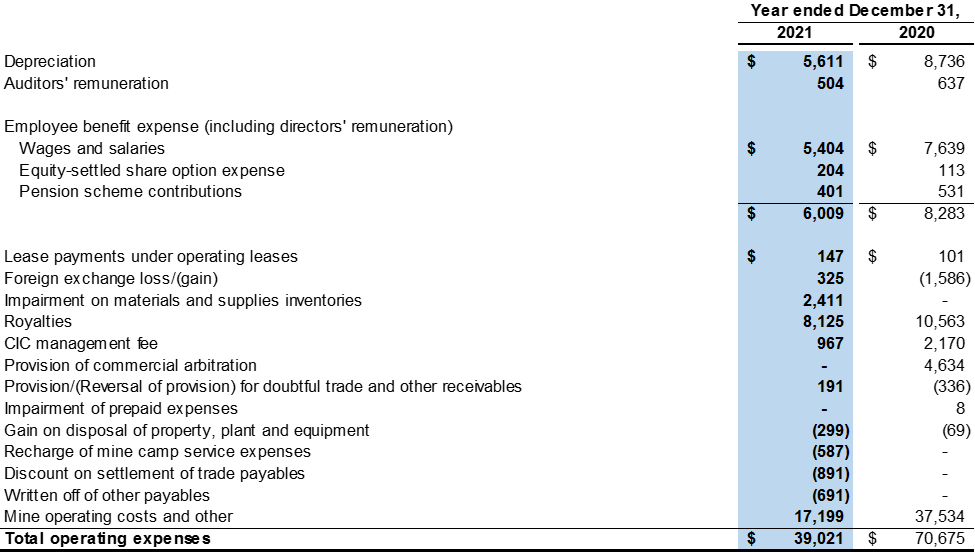

Administration expenses were $6.1 million in 2021 as compared to $7.0 million in 2020, as follows:

Administration expenses were lower for 2021 compared to 2020 primarily due to decrease in salaries and benefits incurred during the year.

The Company continued to minimize evaluation and exploration expenditures in 2021 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in 2021 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

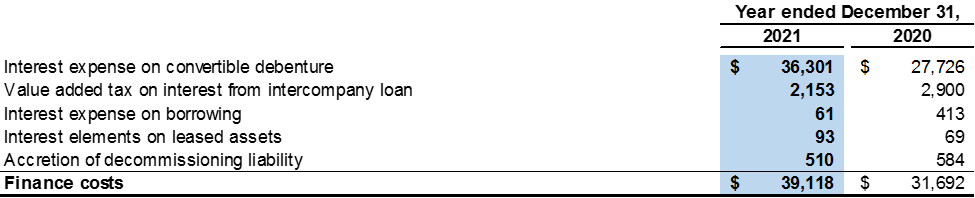

Finance costs were $39.1 million and $31.7 million in 2021 and 2020, respectively, which primarily consisted of interest expense on the $250.0 million CIC Convertible Debenture.

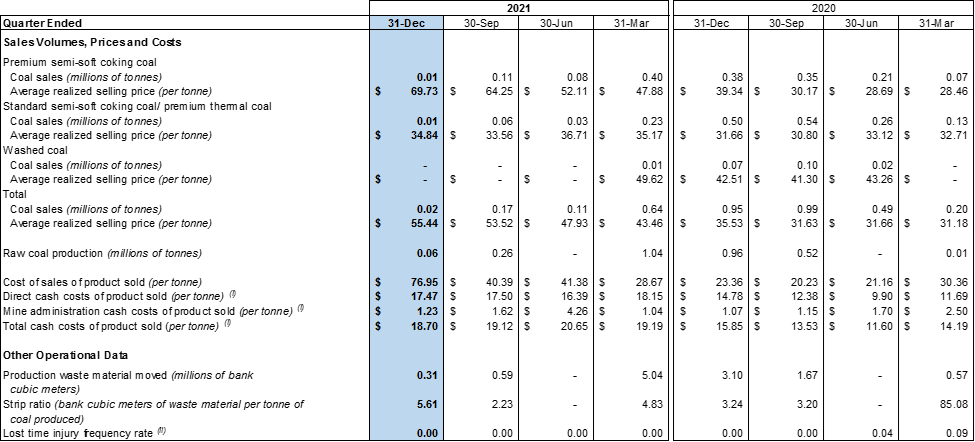

Summary of Quarterly Operational Data

(i) A Non-IFRS financial measure. Refer to "Non-IFRS Financial Measures" section. Cash costs of product sold exclude idled mine asset cash costs.

(ii) Per 200,000 man hours and calculated based on a rolling 12-month average.

Overview of Quarterly Operational Data

The Company ended the fourth quarter of 2021 without a lost time injury.

The Company experienced an increase in the average selling price of coal from $35.5 per tonne in the fourth quarter of 2020 to $55.4 per tonne in the fourth quarter of 2021, as a result of improved market conditions in China and an improvement of the overall product mix. The product mix for the fourth quarter of 2021 consisted of approximately 59% premium semi-soft coking coal and 41% standard semi-soft coking coal/premium thermal coal compared to approximately 40% premium semi-soft coking coal, 53% standard semi-soft coking coal/premium thermal coal and 7% washed coal in the fourth quarter of 2020.

In response to the increase in the number of COVID-19 cases in Ejinaqi, the Ceke Port of Entry was closed in October 2021. Accordingly, the Company's coal exports into China have been suspended and such suspension remains in effect as of the date hereof. As a result, the Company's sales volume decreased from 1.0 million tonnes in the fourth quarter of 2020 to less than 0.1 million tonnes in the fourth quarter of 2021.

In order to control the inventory level and preserve the Company's working capital, the Company temporarily suspended mining operations (including coal mining) beginning in early November 2021. See "Significant Events and Highlights - Impact of the COVID-19 Pandemic" above.

The Company's unit cost of sales of product sold increased from $23.4 per tonne in the fourth quarter of 2020 to $77.0 per tonne in the fourth quarter of 2021. The increase was mainly driven by the diseconomies of scale due to decreased sales as well as the increase in the effective royalty rate.

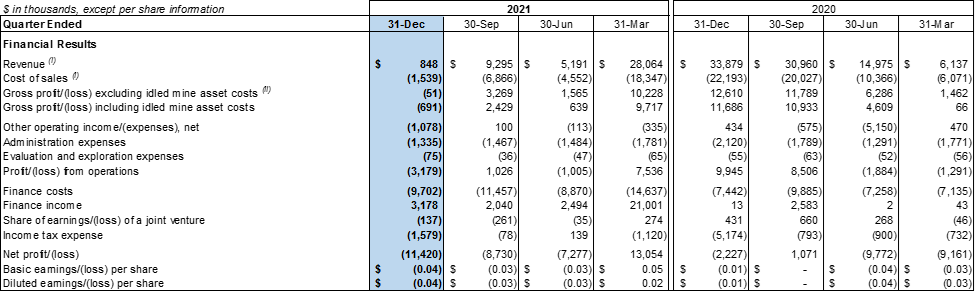

Summary of Quarterly Financial Results

The Company's annual financial statements are reported under International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board ("IASB"). The following table provides highlights, extracted from the Company's annual and interim financial statements, of quarterly results for the past eight quarters:

- Revenue and cost of sales relate to the Company's Ovoot Tolgoi Mine within the Coal Division operating segment. Refer to note 2 of the selected information from the notes to the consolidated financial statements for further analysis regarding the Company's reportable operating segments.

- A Non-IFRS financial measure. Refer to "Non-IFRS Financial Measures" section. Idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

Overview of Quarterly Financial Results

The Company recorded a $3.2 million loss from operations in the fourth quarter of 2021 compared to a $9.9 million profit from operations in the fourth quarter of 2020. The financial results for the fourth quarter of 2021 were impacted by the decreased sales resulting from the export volume limitations as well as the border closure experienced by the Company during the quarter.

Revenue was $0.8 million in the fourth quarter of 2021 compared to $33.9 million in the fourth quarter of 2020. The Company's effective royalty rate for the fourth quarter of 2021, based on the Company's average realized selling price of $55.4 per tonne, was 49.4% or $27.4 per tonne, compared to 12.3% or $4.4 per tonne in the fourth quarter of 2020 (based on the average realized selling price of $35.5 per tonne).

Cost of sales was $1.5 million in the fourth quarter of 2021 compared to $22.2 million in the fourth quarter of 2020. The decrease in cost of sales in the fourth quarter of 2021 was mainly due to the effect of decreased sales volume.

Cost of sales consists of operating expenses, share-based compensation expense, equipment depreciation, depletion of mineral properties, royalties and idled mine asset costs. Operating expenses in cost of sales reflect the total cash costs of product sold (a Non-IFRS financial measure, refer to section "Non-IFRS Financial Measures" for further analysis) during the quarter.

Cost of sales related to idled mine assets in the fourth quarter of 2021 included $0.6 million related to depreciation expenses for idled equipment (fourth quarter of 2020: $0.9 million).

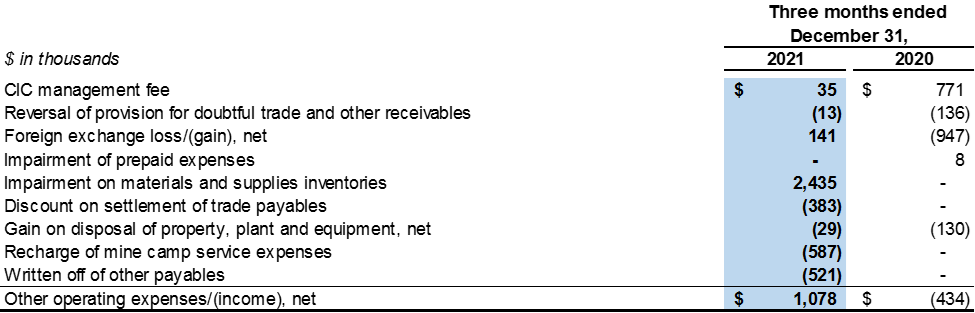

Other operating expenses was $1.1 million in the fourth quarter of 2021 (fourth quarter of 2020: other operating income of $0.4 million). The increase was mainly due to the impairment of materials and supplies inventories of $2.4 million during the fourth quarter of 2021.

Administration expenses decreased from $2.1 million in the fourth quarter of 2020 to $1.3 million in the fourth quarter of 2021, primarily due to decrease in salaries and benefits incurred during the quarter.

The Company continued to minimize evaluation and exploration expenditures in the fourth quarter of 2021 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in the fourth quarter of 2021 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

Finance costs were $6.6 million in the fourth quarter of 2021 compared to $7.4 million in the fourth quarter of 2020, which primarily consisted of interest expense on the $250.0 million CIC Convertible Debenture.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity and Capital Management

The Company has in place a planning, budgeting and forecasting process to help determine the funds required to support the Company's normal operations on an ongoing basis and the Company's expansionary plans.

Costs reimbursable to Turquoise Hill Resources Limited ("Turquoise Hill")

Prior to the completion of a private placement with Novel Sunrise Investments Limited ("Novel Sunrise") on April 23, 2015, Rio Tinto plc ("Rio Tinto") was the Company's ultimate parent company. In the past, Rio Tinto sought reimbursement from the Company for the salaries and benefits of certain Rio Tinto employees who were assigned by Rio Tinto to work for the Company, as well as certain legal and professional fees incurred by Rio Tinto in relation to the Company's prior internal investigation and Rio Tinto's participation in the tripartite committee. Subsequently Rio Tinto transferred and assigned to Turquoise Hill its right to seek reimbursement for these costs and fees from the Company.

On January 20, 2021, the Company and Turquoise Hill entered into a settlement agreement, whereby Turquoise Hill agreed to a repayment schedule in settlement of certain secondment costs in the amount of $2.8 million (representing a portion of the TRQ Reimbursable Amount) pursuant to which the Company agreed to make monthly payments to Turquoise Hill in the amount of $0.1 million per month from January 2021 to June 2022. The Company is contesting the validity of the remaining balance of the TRQ Reimbursable Amount claimed by Turquoise Hill.

As at December 31, 2021, the amount of reimbursable costs and fees claimed by Turquoise Hill (the "TRQ Reimbursable Amount") amounted to $6.8 million (such amount is included in the trade and other payables).

Going concern considerations

The Company's consolidated financial statements have been prepared on a going concern basis which assumes that the Company will continue to operate until at least December 31, 2022 and will be able to realize its assets and discharge its liabilities in the normal course of operations as they come due. However, in order to continue as a going concern, the Company must generate sufficient operating cash flows, secure additional capital or otherwise pursue a strategic restructuring, refinancing or other transactions to provide it with sufficient liquidity.

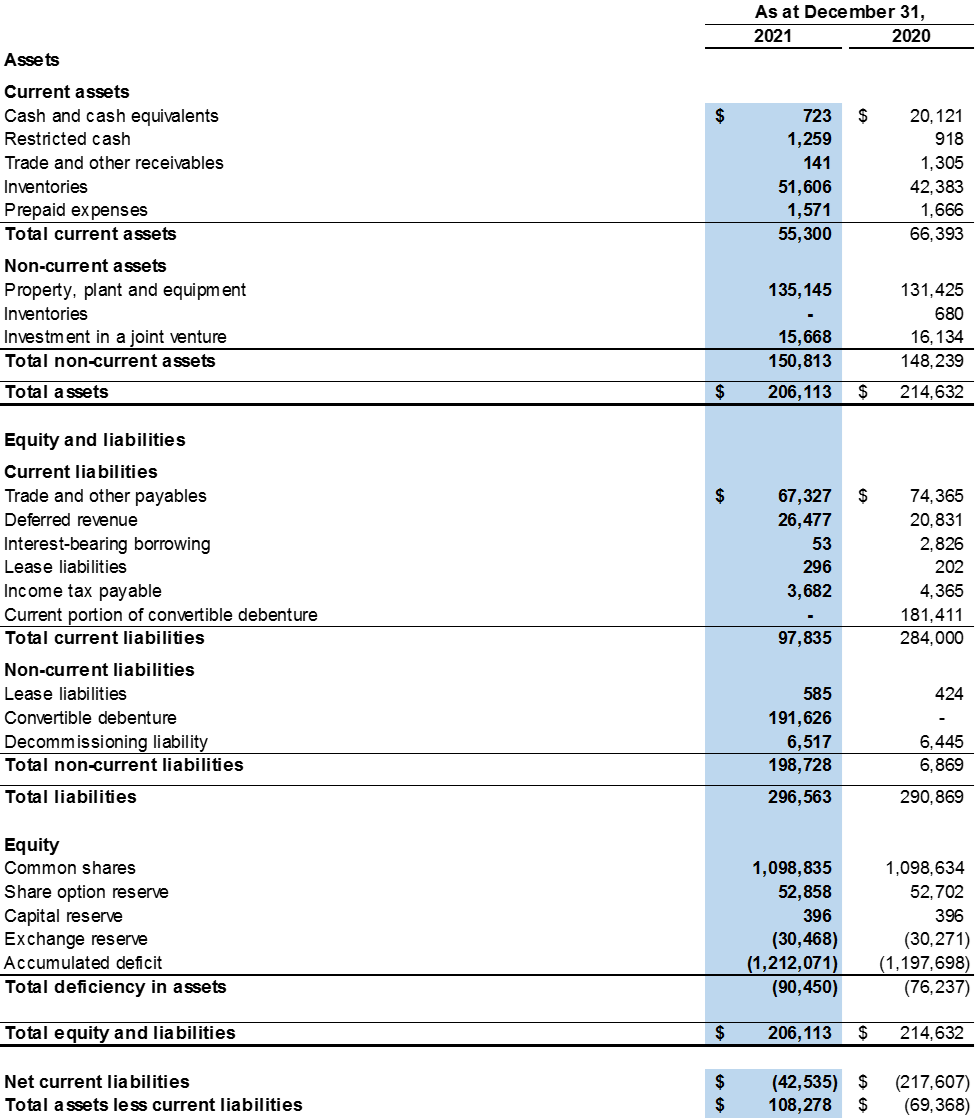

Several adverse conditions and material uncertainties cast significant doubt upon the Company's ability to continue as a going concern and the going concern assumption used in the preparation of the Company's consolidated financial statements. The Company had a deficiency in assets of $90.5 million as at December 31, 2021 as compared to a deficiency in assets of $76.2 million as at December 31, 2020 while the working capital deficiency (excess current liabilities over current assets) reached $42.5 million as at December 31, 2021 compared to a working capital deficiency of $217.6 million as at December 31, 2020.

Included in the working capital deficiency as at December 31, 2021 are significant obligations, mainly comprised of trade and other payables of $67.3 million, which includes $22.1 million in unpaid taxes that are repayable on demand to the Mongolian Tax Authority ("MTA").

The Company may not be able to settle all trade and other payables on a timely basis, while continuing to postpone the settlement of certain trade payables owed to suppliers and creditors may impact the mining operations of the Company and may result in potential lawsuits and/or bankruptcy proceedings being filed against the Company. Except as disclosed elsewhere in this press release, no such lawsuits or proceedings are pending as at March 30, 2022. However, there can be no assurance that no such lawsuits or proceedings will be filed by the Company's creditors in the future and the Company's suppliers and contractors will continue to supply and provide services to the Company uninterrupted.

There are significant uncertainties as to the outcomes of the above events or conditions that may cast significant doubt on the Company's ability to continue as a going concern and, therefore, the Company may be unable to realize its assets and discharge its liabilities in the normal course of business. Should the use of the going concern basis in preparation of the consolidated financial statements be determined to be not appropriate, adjustments would have to be made to write down the carrying amounts of the Company's assets to their realizable values, to provide for any further liabilities which might arise and to reclassify non-current assets and non-current liabilities as current assets and current liabilities, respectively. The effects of these adjustments have not been reflected in the consolidated financial statements. If the Company is unable to continue as a going concern, it may be forced to seek relief under applicable bankruptcy and insolvency legislation.

Management of the Company has prepared a cash flow projection covering a period of 12 months from December 31, 2021. The cash flow projection has taken into account the anticipated cash flows to be generated from the Company's business during the period under projection including cost saving measures. In particular, the Company has taken into account the following measures for improvement of the Company's liquidity and financial position, which include: (a) entering into the deferral agreement signed on November 19, 2020 (the "2020 November Deferral Agreement") and the 2021 July Deferral Agreement with CIC for a deferral of (i) deferred cash interest and deferral fees of $75.2 million which were due and payable to CIC on or before September 14, 2020, under the deferral agreement signed on June 19, 2020 (the "2020 June Deferral Agreement"); (ii) semi-annual cash interest payments in the aggregate amount of $16.0 million payable to CIC on November 19, 2020 and May 19, 2021; (iii) $4.0 million worth of PIK Interest shares ("2020 November PIK Interest") issuable to CIC on November 19, 2020 under the CIC Convertible Debenture; and (iv) the management fee which payable to CIC on November 14, 2020, February 14, 2021, May 15, 2021, August 14, 2021 and November 14, 2021 under the Amended and Restated Cooperation Agreement (collectively, the "2020 November Deferral Amounts") and the 2021 Deferral Amounts respectively until August 31, 2023; (b) agreeing to deferral arrangements and improved payment terms with certain vendors; (c) reducing the outstanding tax payable by making payments to the MTA; and (d) reducing the inventory of low quality coal by wet washing. After considering the above, the directors of the Company believe that there will be sufficient financial resources to continue its operations and to meet its financial obligations as and when they fall due in the next 12 months from December 31, 2021 and therefore are satisfied that it is appropriate to prepare the condensed consolidated interim financial statements on a going concern basis.

Factors that impact the Company's liquidity are being closely monitored and include, but are not limited to, impact of the COVID-19 pandemic, restrictions on the Company's ability to import its coal products for sale in China, China's economic growth, market prices of coal, production levels, operating cash costs, capital costs, exchange rates of currencies of countries where the Company operates and exploration and discretionary expenditures.

As at December 31, 2021 and December 31, 2020, the Company was not subject to any externally imposed capital requirements.

Impact of the COVID-19 Pandemic

Since the second quarter of 2021, additional precautionary measures were imposed by the Chinese authorities at the Ceke Port of Entry in response to the increase of COVID-19 cases in Mongolia, which included restricting the number of trucks crossing the Mongolian border into China. The restrictions on trucking volume have had an adverse impact on the Company's ability to import its coal products into China in 2021.

In response to the increase in the number of COVID-19 cases in Ejinaqi, a region in China's Inner Mongolia Autonomous Region, reported in late October 2021, the local government authorities have imposed stringent preventive measures throughout the region, including the temporary closure of the Ceke Port of Entry located at the border of Mongolia and China. Accordingly, the Company's coal exports into China have been suspended and such suspension remains in effect as of the date hereof. The Company anticipates the temporary closure of the Ceke Port of Entry will have a material adverse impact on the Company's sales and cash flow until such time as coal exports into China are allowed to resume. In order to control the inventory level and preserve the Company's working capital, the Company temporarily suspended mining operations (including coal mining) beginning in early November 2021.

The Company will continue to closely monitor the COVID-19 pandemic and the impact it has on coal exports to China and will continue to react promptly to preserve the working capital of the Company and mitigate any negative impacts on the business and operations of the Company.

CIC Convertible Debenture

In November 2009, the Company entered into a financing agreement with CIC for $500 million in the form of a secured, convertible debenture bearing interest at 8.0% (6.4% payable semi-annually in cash and 1.6% payable annually in the Company's Common Shares) with a maximum term of 30 years. The CIC Convertible Debenture is secured by a first ranking charge over the Company's assets, including shares of its material subsidiaries. The financing was used primarily to support the accelerated investment program in Mongolia and for working capital, repayment of debts, general and administrative expenses and other general corporate purposes.

On March 29, 2010, the Company exercised its right to call for the conversion of up to $250.0 million of the CIC Convertible Debenture into approximately 21.5 million shares at a conversion price of $11.64 (CAD$11.88). As at June 30, 2021, CIC owned approximately 23.7% of the issued and outstanding Common Shares of the Company.

On November 19, 2020, the Company and CIC entered into the 2020 November Deferral Agreement pursuant to which CIC agreed to grant the Company a deferral of the 2020 November Deferral Amounts. The 2020 November Deferral Agreement became effective on January 21, 2021, being the date on which the 2020 November Deferral Agreement was approved by shareholders at the Company's annual and special meeting of shareholders.

The principal terms of the 2020 November Deferral Agreement are as follows:

- Payment of the 2020 November Deferral Amounts will be deferred until August 31, 2023.

- CIC agreed to waive its rights arising from any default or event of default under the CIC Convertible Debenture as a result of trading in the Common Shares being halted on the TSX beginning as of June 19, 2020 and suspended on the HKEX beginning as of August 17, 2020, in each case for a period of more than five trading days.

- As consideration for the deferral of the 2020 November Deferral Amounts, the Company agreed to pay CIC: (i) a deferral fee equal to 6.4% per annum on the 2020 November Deferral Amounts payable under the CIC Convertible Debenture and the 2020 June Deferral Agreement, commencing on the date on which each such 2020 November Deferral Amounts would otherwise have been due and payable under the CIC Convertible Debenture or the 2020 June Deferral Agreement, as applicable; and (ii) a deferral fee equal to 2.5% per annum on the 2020 November Deferral Amounts payable under the Amended and Restated Cooperation Agreement, commencing on the date on which the management fee would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2020 November Deferral Agreement does not contemplate a fixed repayment schedule for the 2020 November Deferral Amounts and related deferral fees. Instead, the Company and CIC would agree to assess in good faith the Company's financial condition and working capital position on a monthly basis and determine the amount, if any, of the 2020 November Deferral Amounts and related deferral fees that the Company is able to repay under the CIC Convertible Debenture, the 2020 June Deferral Agreement or the Amended and Restated Cooperation Agreement, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- Commencing as of November 19, 2020 and until such time as the November 2020 PIK Interest is fully repaid, CIC reserves the right to require the Company to pay and satisfy the amount of the November 2020 PIK Interest, either in full or in part, by way of issuing and delivering PIK Interest shares in accordance with the CIC Convertible Debenture provided that, on the date of issuance of such shares, the Common Shares are listed and trading on at least one stock exchange.

- If at any time before the 2020 November Deferral Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its Chief Executive Officer, its Chief Financial Officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, then the Company must first consult with, and obtain written consent from CIC prior to effecting such appointment, replacement or termination.

On July 30, 2021, the Company and CIC entered into the 2021 July Deferral Agreement pursuant to which CIC agreed to grant the Company a deferral of: (i) semi-annual cash interest payments of $8.1 million payable to CIC on November 19, 2021; and (ii) $4.0 million in PIK Interest shares issuable to CIC on November 19, 2021 under the CIC Convertible Debenture.

The principal terms of the 2021 July Deferral Agreement are as follows:

- Payment of the 2021 Deferral Amounts will be deferred until August 31, 2023.

- As consideration for the deferral of the 2021 Deferral Amounts, the Company agreed to pay CIC a deferral fee equal to 6.4% per annum on the 2021 Deferral Amounts payable under the CIC Convertible Debenture, commencing on November 19, 2021.

Ovoot Tolgoi Mine Impairment Analysis

The Company determined that an indicator of impairment existed for its Ovoot Tolgoi Mine cash generating unit as at December 31, 2021. The impairment indicator was the fact that the Company suffered loss for the year.

Therefore, the Company conducted an impairment test whereby the carrying value of the Company's Ovoot Tolgoi Mine cash generating unit was compared to the recoverable amount (being the "fair value less costs of disposal") using a discounted future cash flow valuation model. The Company's cash flow valuation model takes into consideration the latest available information to the Company, including but not limited to, sales prices, sales volumes, washing production, operating costs and life of mine coal production estimates as at December 31, 2021. The carrying value of the Company's Ovoot Tolgoi Mine cash generating unit was $133.1 million.

Key estimates and assumptions incorporated in the valuation model included the following:

- Coal resources and reserves as estimated by an independent third party engineering firm;

- Sales price estimates from an independent market consulting firm;

- Forecastedsales volumes in line with production levels as reference to the mine plan;

- Life-of-mine coal production, strip ratio, capital costs and operating costs; and

- A post-tax discount rate of 17% based on an analysis of the market, country and asset specific factors.

Key sensitivities in the valuation model are as follows:

- For each 1% increase/(decrease) in the long term price estimates, the calculated fair value of the cash generating unit increases/(decreases) by approximately $14.7/(14.8) million;

- For each 1% increase/(decrease) in the post-tax discount rate, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(21.6)/23.5 million;

- For each 1% increase/(decrease) in the cash mining cost estimates, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(9.0)/8.9 million; and

- For each 1% increase/(decrease) in Mongolian inflation rate, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(6.1)/6.0 million.

The impairment analysis did not result in the identification of an impairment loss or an impairment reversal and no charge or reversal was required as at December 31, 2021. A decline of 25% in the long-term price estimates, an increase of more than 100% in the post-tax discount rate, an increase of 42% in the cash mining cost estimates or an increase of 48% in Mongolian inflation rate may trigger an impairment charge on the cash generating unit. The Company believes that the estimates and assumptions incorporated in the impairment analysis are reasonable; however, the estimates and assumptions are subject to significant uncertainties and judgments.

The Company cautions that the above discussion on Ovoot Tolgoi Mine Impairment Analysis is unaudited and has not been agreed upon by the Auditors.

REGULATORY ISSUES AND CONTINGENCIES

Class Action Lawsuit

In January 2014, Siskinds LLP, a Canadian law firm, filed a class action (the "Class Action") against the Company, certain of its former senior officers and directors, and its former auditors (the "Former Auditors"), in the Ontario Court in relation to the Company's restatement of certain financial statements previously disclosed in the Company's public fillings (the "Restatement").

To commence and proceed with the Class Action, the plaintiff was required to seek leave of the Court under the Ontario Securities Act ("Leave Motion") and certify the action as a class proceeding under the Ontario Class Proceedings Act. The Ontario Court rendered its decision on the Leave Motion on November 5, 2015, dismissing the action against the former senior officers and directors and allowing the action to proceed against the Company in respect of alleged misrepresentation affecting trades in the secondary market for the Company's securities arising from the Restatement. The action against the Former Auditors was settled by the plaintiff on the eve of the Leave Motion.

Both the plaintiff and the Company appealed the Leave Motion decision to the Ontario Court of Appeal. On September 18, 2017, the Ontario Court of Appeal dismissed the Company's appeal of the Leave Motion to permit the plaintiff to commence and proceed with the Class Action. Concurrently, the Ontario Court of Appeal granted leave for the plaintiff to proceed with their action against the former senior officers and directors in relation to the Restatement.

The Company filed an application for leave to appeal to the Supreme Court of Canada in November 2017, but the leave to appeal to the Supreme Court of Canada was dismissed in June 2018.

In December 2018, the parties agreed to a consent Certification Order, whereby the action against the former senior officers and directors was withdrawn and the Class Action would only proceed against the Company.

Counsel for the plaintiff and defendants have agreed on and the case management judge has ordered a trial to commence in December 2022 (subject to Court availability). To accomplish all steps necessary for trial preparation, counsels have agreed to the following proposed schedule under the case management of the judge: (i) document production and pleading amendments by October 31, 2021; (ii) oral examinations for discovery ending by December 31, 2022; (iii) expert reports of plaintiff by April 25, 2022 and by defendants August 22, 2022; and (iv) pre-trial agreements, filings and motions by August 31, 2022. The Company has urged a trial as early as possible.

The Company firmly believes that it has a strong defense on the merits and will continue to vigorously defend itself against the Class Action through independent Canadian litigation counsel retained by the Company for this purpose. Due to the inherent uncertainties of litigation, it is not possible to predict the final outcome of the Class Action or determine the amount of potential losses, if any. However, the Company has determined that a provision for this matter as at December 31, 2021 was not required.

Toll Wash Plant Agreement with Ejin Jinda

In 2011, the Company entered into an agreement with Ejin Jinda, a subsidiary of China Mongolia Coal Co. Ltd., to toll-wash coal from the Ovoot Tolgoi Mine. The agreement had a duration of five years from the commencement of the contract and provided for an annual washing capacity of approximately 3.5 million tonnes of input coal.

Under the agreement with Ejin Jinda, which required the commercial operation of the wet washing facility to commence on October 1, 2011, the additional fees payable by the Company under the wet washing contract would have been $18.5 million. At each reporting date, the Company assesses the agreement with Ejin Jinda and has determined it is not probable that this $18.5 million will be required to be paid. Accordingly, the Company has determined that a provision for this matter as at December 31, 2021 was not required.

Special Needs Territory in Umnugobi

On February 13, 2015, the Soumber mining licenses (MV-016869, MV-020436 and MV-020451) (the "License Areas") were included into a special protected area (to be further referred as Special Needs Territory, the "SNT") newly set up by the Umnugobi Aimag's Civil Representatives Khural (the "CRKh") to establish a strict regime on the protection of natural environment and prohibit mining activities in the territory of the SNT.

On July 8, 2015, SouthGobi Sands LLC, a wholly owned subsidiary of the Company ("SGS"), and the chairman of the CRKh, in his capacity as the respondent's representative, reached an agreement (the "Amicable Resolution Agreement") to exclude the License Areas from the territory of the SNT in full, subject to confirmation of the Amicable Resolution Agreement by the session of the CRKh. The parties formally submitted the Amicable Resolution Agreement to the appointed judge of the Administrative Court for her approval and requested a dismissal of the case in accordance with the Law of Mongolia on Administrative Court Procedure. On July 10, 2015, the judge issued her order approving the Amicable Resolution Agreement and dismissing the case, while reaffirming the obligation of CRKh to take necessary actions at its next session to exclude the License Areas from the SNT and register the new map of the SNT with the relevant authorities. Mining activities at the Soumber property cannot proceed unless and until the Company obtains a court order restoring the Soumber mining licenses and until the License Areas are removed from the SNT.

On July 24, 2021, SGS was notified by the Implementing Agency of Mongolian Government that the license area covered by two mining licenses (MV-016869 and MV-020451) are no longer overlapping with the SNT. The Company will continue to work with the Mongolian authorities regarding the license area covered by the mining license (MV-020436).

Mongolian royalties

On June 23, 2021, the Government of Mongolia issued a new resolution in connection with the royalty regime. From July 1, 2021 onwards, the royalty payable is to be calculated based on the reference price as determined by the Government of Mongolia, and the reference to the contract sales price will be removed.

Importing F-Grade Coal into China

As a result of import coal quality standards established by Chinese authorities, the Company has not been able to export its F-grade coal products into China since December 15, 2018 because the F-grade coal products do not meet the quality requirement.

TRANSPORTATION INFRASTRUCTURE

On August 2, 2011, the State Property Committee of Mongolia awarded the tender to construct a paved highway from the Ovoot Tolgoi Mine to the Shivee Khuren Border Crossing (the "Paved Highway") to consortium partners NTB LLC and SGS (together referred to as "RDCC LLC") with an exclusive right of ownership of the Paved Highway for 30 years. The Company has an indirect 40% interest in RDCC LLC through its Mongolian subsidiary SGS. The toll rate is MNT 1,500 per tonne.

The Paved Highway has a carrying capacity in excess of 20 million tonnes of coal per year.

For the three months ended and the year ended December 31, 2021, RDCC LLC recognized toll fee revenue of $0.1 million (2020: $1.9 million) and $2.1 million (2020: $5.7 million), respectively.

PLEDGE OF ASSETS

As at December 31, 2021, one of the Company's property, plant and equipment with a carrying value of $nil (December 31, 2020: $0.1 million) was pledged as security for a bank loan granted to the Company.

PURCHASE, SALE OR REDEMPTION OF LISTED SECURITIES OF THE COMPANY

The Company did not redeem its listed securities, nor did the Company or any of its subsidiaries purchase or sell such securities during the year ended December 31, 2021.

COMPLIANCE WITH CORPORATE GOVERNANCE

The Company has, throughout the year ended December 31, 2021, applied the principles and complied with the requirements of its corporate governance practices as defined by the Board and complied with all applicable statutory, regulatory and stock exchange listings standards, which include the code provisions set out in the Corporate Governance Code (the "Corporate Governance Code") contained in Appendix 14 to the Hong Kong Listing Rules, except for the following:

- Pursuant to Section C.2 under Part 2 of the Corporate Governance Code, the chairman of the Board ("Chairman") should be responsible for the overall management of the Board. The Company has not had a Chairman since November 2017. The Board has appointed an Independent Lead Director, who is fulfilling the duties of the Chairman; and

- Pursuant to code provision F.2.2 under Part 2 of the Corporate Governance Code, the Chairman of the Board should attend the annual general meeting. Mr. Mao Sun, an independent non-executive director ("INED") and the Independent Lead Director, attended and acted as Chairman of the Company's annual general and special meeting held on June 29, 2021 to ensure effective communication with shareholders of the Company (the "Shareholders").

Pursuant to provision C.2.7 under Part 2 of the Corporate Governance Code, the Chairman of the Board should at least annually hold meetings with the non-executive directors (including INEDs) without executive directors present. During 2021, there was one meeting between the Independent Lead Director, who is fulfilling the duties of the Chairman, and the non-executive Directors. The opportunity for such communication channel is available at the end of each Board meeting.

SECURITIES TRANSACTIONS BY DIRECTORS

The Company has adopted policies regarding directors' securities transactions in its Corporate Disclosure, Confidentiality and Securities Trading Policy that have terms, which contain no less exacting than those set out in the Model Code for Securities Transactions by Directors of Listed Issuers contained in Appendix 10 to the Hong Kong Listing Rules.

Having made specific enquiry of all Directors, the Company received written confirmation from its directors that all directors had received, reviewed and abided by the terms of the Company's Corporate Disclosure, Confidentiality and Securities Trading Policy throughout the year ended December 31, 2021.

OUTLOOK

The COVID-19 pandemic has caused unprecedented challenges around the world and adversely impacted the global economy. The Company has adopted, and will continue to implement, strict COVID-19 precautionary measures at the mine site as well as in all of its offices in order to maintain operations in the normal course, while also complying with the advice or orders of local public health authorities.

As a result of the restrictions on truck volume crossing the Mongolian border into China imposed by Chinese Authorities at the Ceke Port of Entry, the Company anticipates that it will continue to be negatively impacted by the COVID-19 pandemic for the foreseeable future until restrictions on trucking volume crossing are lifted, which will have an adverse effect on the Company's sales, production, logistics and financials. In particular, the restriction of the number of trucks crossing the Mongolian border into China implemented will limit the Company's ability to increase revenue despite the improved market conditions in China.

Following the recent temporary closure of the Ceke border, there will be a material adverse impact on the Company's sales and cash flow until such time as coal exports into China are allowed to resume. In order to control the inventory level and preserve the Company's working capital, the Company temporarily suspended mining operations (including coal mining) beginning in early November 2021. The Company will continue to closely monitor the COVID-19 pandemic and the impact it has on coal exports to China, and will continue to react promptly to preserve the working capital of the Company and mitigate any negative impacts on the business and operations of the Company.

The Company remains cautiously optimistic regarding the Chinese coal market, as coal is still considered to be the primary energy source which China will continue to rely on in the foreseeable future. Coal supply and coal import in China are expected to be limited due to increasingly stringent requirements relating to environmental protection and safety production, which may result in volatile coal prices in China. The Company will continue to monitor and react proactively to the dynamic market.

In the medium term, the Company will continue to adopt various strategies to enhance its product mix in order to maximize revenue, expand its customer base and sales network, improve logistics, optimize its operational cost structure and, most importantly, operate in a safe and socially responsible manner.

The Company's objectives for the medium term are as follows:

- Enhance product mix - The Company will focus on improving the product mix and increasing the production of higher quality coal by: (i) improving mining operations; (ii) washing lower quality coal in the Company's coal wash plant and partnering with other nearby coal wash plant(s); (iii) resuming the construction and operation of the Company's dry coal processing plant; and (iv) trading and blending different types of coal to produce blended coal products that are economical to the Company.

- Expand customer base - The Company will endeavour to increase sales volume and sales price by: (i) expanding its sales network and diversifying its customer base; (ii) increasing its coal logistics capacity to resolve the bottleneck in the distribution channel; and (iii) setting and adjusting the sales price based on a more market-oriented approach in order to maximize profit while maintaining sustainable long-term business relationships with customers.

- Optimize cost structure - The Company will aim to reduce its production costs and optimize its cost structure through engaging third party contract mining companies to enhance its operation efficiency, strengthening procurement management, ongoing training and productivity enhancement.

- Operate in a safe and socially responsible manner - The Company will continue to maintain the highest standards in health, safety and environmental performance and operate in a corporate socially responsible manner, and continue to strictly implement its COVID-19 precautionary measures at the mine site and across all offices.

In the long term, the Company will continue to focus on creating and maximizing shareholders value by leveraging its key competitive strengths, including:

- Strategic location - The Ovoot Tolgoi Mine is located approximately 40km from China, which represents the Company's main coal market. The Company has an infrastructure advantage, being approximately 50km from a major Chinese coal distribution terminal with rail connections to key coal markets in China.

- A large reserves base - The Ovoot Tolgoi Deposit has mineral reserves of more than 100 million tonnes. The Company also has several development options in its Zag Suuj coal deposit and Soumber coal deposit.

- Bridge between Mongolia and China - The Company is well-positioned to capture the resulting business opportunities between China and Mongolia under the Belt and Road Initiative. The Company will seek potential strategic support from its two largest shareholders, which are both state-owned-enterprises in China, and its strong operational record for the past decade in Mongolia, being one of the largest enterprises and taxpayers in Mongolia.

NON-IFRS FINANCIAL MEASURES

Cash Costs

The Company uses cash costs to describe its cash production and associated cash costs incurred in bringing the inventories to their present locations and conditions. Cash costs incorporate all production costs, which include direct and indirect costs of production, with the exception of idled mine asset costs and non-cash expenses which are excluded. Non-cash expenses include share-based compensation expense, impairment of coal stockpile inventories, depreciation and depletion of property, plant and equipment and mineral properties. The Company uses this performance measure to monitor its operating cash costs internally and believes this measure provides investors and analysts with useful information about the Company's underlying cash costs of operations. The Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its mining operations to generate cash flows. The Company reports cash costs on a sales basis. This performance measure is commonly utilized in the mining industry.

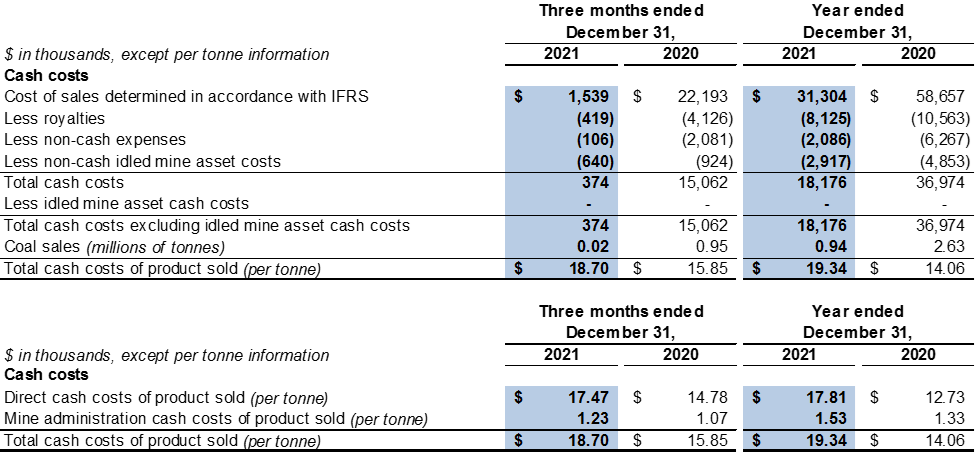

The following table provides a reconciliation of the cash costs of product sold disclosed for the three months and year ended December 31, 2021 and December 31, 2020. The cash costs of product sold presented below may differ from cash costs of product produced depending on the timing of coal stockpile inventory turnover and impairment of coal stockpile inventories from prior periods.

The cash cost of product sold per tonne was $18.7 for 2021, which has decreased from $19.3 per tonne for 2020. The reason for the decrease is primarily related to (i) diseconomies of scale given the decreased sales; and (ii) a higher portion of coal was transported to the Company's Inner Mongolia subsidiary and sold to third party customers within China instead of selling at the mine gate during the year.

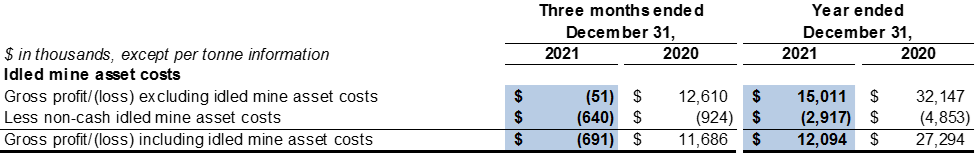

Idle Mine Asset Costs

The Company uses idle mine asset costs to describe the cost incurred during idle mine period. Idle mine asset costs include share-based compensation expense, impairment of coal stockpile inventories, depreciation and depletion of property, plant and equipment and mineral properties. The Company uses this performance measure to monitor its gross profit internally and believes this measure provides investors and analysts with useful information about the Company's underlying gross profit. The Company believes that conventional measures of performance prepared in accordance with IFRS do not fully illustrate the ability of its mining operations to generate cash flows. This performance measure is commonly utilized in the mining industry.

The following table provides a reconciliation of the gross profit/(loss) disclosed for the three months and year ended December 31, 2021 and December 31, 2020.

The Company cautions that the financial results for its financial year ended December 31, 2021 set forth below are unaudited and have not been agreed upon with the Auditors.

Consolidated Statement of Comprehensive Income

(Expressed in thousands of USD, except for share and per share amounts)

Consolidated Statement of Financial Position

(Expressed in thousands of USD)

SELECTED INFORMATION FROM THE NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Additional information required by the HKEX and not disclosed elsewhere in this press release is as follows. All amounts are expressed in thousands of USD and shares and options in thousands, unless otherwise indicated.

1. BASIS OF PREPARATION

1.1 Corporate information and liquidity

The Company's consolidated financial statements have been prepared on a going concern basis which assumes that the Company will continue operating until at least December 31, 2022 and will be able to realize its assets and discharge its liabilities in the normal course of operations as they come due. However, in order to continue as a going concern, the Company must generate sufficient operating cash flows, secure additional capital or otherwise pursue a strategic restructuring, refinancing or other transactions to provide it with sufficient liquidity.

Several adverse conditions and material uncertainties cast significant doubt upon the Company's ability to continue as a going concern and the going concern assumption used in the preparation of the Company's consolidated financial statements. The Company incurred a loss attributable to equity holders of the Company of $14,373 for the year ended December 31, 2021 (compared to a loss attributable to equity holders of the Company of $20,089 for the year ended December 31, 2020), and as of that date, had a deficiency in assets of $90,450 as compared to a deficiency in assets of $76,237 as at December 31, 2020 while the working capital deficiency (excess current liabilities over current assets) reached $42,535 as at December 31, 2021 compared to a working capital deficiency of $217,607 as at December 31, 2020.

Included in the working capital deficiency as at December 31, 2021 are significant obligations, which include the interest amounting to $25,274 in relation to the convertible debenture with CIC and trade and other payables of $67,327, which includes the unpaid taxes of $22,075 that are repayable on demand to MTA.

The Company may not be able to settle all trade and other payables on a timely basis, and as a result any continuing postponement in settling certain trade and other payables owed to suppliers and creditors may impact the mining operations of the Company and may result in potential lawsuits and/or bankruptcy proceedings being filed against the Company. Except as disclosed elsewhere in this press release, no such lawsuits or proceedings were pending as at March 30, 2022.

There are significant uncertainties as to the outcomes of the above events or conditions that may cast significant doubt on the Company's ability to continue as a going concern and, therefore, the Company may be unable to realize its assets and discharge its liabilities in the normal course of business. Should the use of the going concern basis in preparation of the consolidated financial statements be determined to be not appropriate, adjustments would have to be made to write down the carrying amounts of the Company's assets to their realizable values, to provide for any further liabilities which might arise and to reclassify non-current assets and non-current liabilities as current assets and current liabilities, respectively. The effects of these adjustments have not been reflected in the consolidated financial statements. If the Company is unable to continue as a going concern, it may be forced to seek relief under applicable bankruptcy and insolvency legislation.

Management of the Company has prepared a cash flow projection covering a period of 12 months from December 31, 2021. The cash flow projection has taken into account the anticipated cash flow to be generated from the Company's business during the period under projection including cost saving measures. In particular, the Company has taken into account the following measures for improvement of the Company's liquidity and financial position, which include: (a) entering into the 2020 November Deferral Agreement and the 2021 July Deferral Agreement with CIC for a deferral of (i) deferred cash interest and deferral fees of $75.2 million which were due and payable to CIC on or before September 14, 2020, under the 2020 June Deferral Agreement; (ii) semi-annual cash interest payments in the aggregate amount of $16.0 million payable to CIC on November 19, 2020 and May 19, 2021; (iii) $4.0 million worth of 2020 November PIK Interest issuable to CIC on November 19, 2020 under the CIC Convertible Debenture; and (iv) the management fee which payable to CIC on November 14, 2020, February 14, 2021, May 15, 2021, August 14, 2021 and November 14, 2021 under the Amended and Restated Cooperation Agreement and the 2021 Deferral Amounts respectively until August 31, 2023; (b) agreeing to deferral arrangements and improved payment terms with certain vendors; (c) reducing the outstanding tax payable by making monthly payments to the MTA beginning as of June 2020; and (d) reducing the inventory of low quality coal by wet washing. After considering the above, the Directors believe that there will be sufficient financial resources to continue its operations and to meet its financial obligations as and when they fall due in the next 12 months from December 31, 2021 and therefore are satisfied that it is appropriate to prepare the consolidated financial statements on a going concern basis.

Factors that impact the Company's liquidity are being closely monitored and include, but are not limited to, impact of the COVID-19 pandemic, Chinese economic growth, market prices of coal, production levels, operating cash costs, capital costs, exchange rates of currencies of countries where the Company operates and exploration and discretionary expenditures.

As at December 31, 2021 and December 31, 2020, the Company was not subject to any externally imposed capital requirements.

1.2 Statement of compliance

The consolidated financial statements, including comparatives, have been prepared in accordance with the IFRS issued by the IASB.

The consolidated financial statements of the Company for the year ended December 31, 2021 were approved and authorized for issue by the Board of the Company on March 30, 2022.

1.3 Basis of presentation

The consolidated financial statements have been prepared on a historical cost basis except for certain financial assets and financial liabilities which are measured at fair value.

1.4 Adoption of new and revised standards and interpretations

The following new IFRS standards and interpretations were adopted by the Company on January 1, 2021.

Amendments to IFRS 16 | Covid-19-Related Rent Concessions |

Amendments to IFRS 16 | Covid-19-Related Rent Concessions beyond 30 June 2021 |

Amendments to IAS 39, IFRS 4, IFRS 7, IFRS 9 and IFRS 16, | Interest Rate Benchmark Reform - Phase 2 |

There have been no new IFRSs or IFRIC interpretations that have a material impact on the Company's results and financial position for the year ended December 31, 2021. The Company has not early applied any new or amended IFRSs that is not yet effective for the year ended December 31, 2021.

2. SEGMENT INFORMATION

The Company's Chief Executive Officer (chief operating decision maker) reviews the financial information in order to make decisions about resources to be allocated to the segment and to assess its performance. No operating segment identified by the Board of Directors has been aggregated in arriving at the reporting segments of the Company. For management's purpose, the Company has only one reportable operating segment, which is the coal division. The division is principally engaged in coal mining, development and exploration in Mongolia, and logistics and trading of coal in Mongolia and China for the years ended December 31, 2021 and 2020.

The Company's resources are integrated and as a result, no discrete operating segment financial information is available. Since this is the only reportable and operating segment of the Company, no further analysis thereof is presented. All the revenue of the Company is generated from trading of coal for the years ended December 31, 2021 and 2020.

During the years ended December 31, 2021 and 2020, the Coal Division had 22 and 14 active customers, respectively. 3 customers with respective revenues contributed over 10% of the total revenue during the year ended December 31, 2021 and 2020, with the largest customer accounting for 35% of revenues (2020: 26%), the second largest customer accounting for 17% of revenues (2020: 18%) and the third largest customer accounting for 10% of revenues (2020: 15%)

3. REVENUE

Revenue represents the value of goods sold which arises from the trading of coal. The Company recognizes all revenue from the trading of coal at a point in time when the customer obtains control of the goods or services.

4. EXPENSES BY NATURE

The Company's loss before tax is arrived at after charging/(crediting):

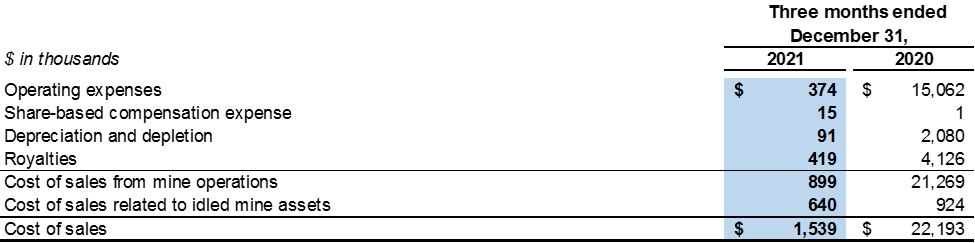

5. COST OF SALES

The Company's cost of sales consists of the following amounts:

(i) Cost of sales related to idled mine assets for the year ended December 31, 2021 includes $2,917 of depreciation expense (2020: includes $4,853 of depreciation expense). The depreciation expense relates to the Company's idled plant and equipment.

Cost of inventories recognized as expense in cost of sales for the year ended December 31, 2021 totaled $17,000 (2020: $38,499).

6. OTHER OPERATING EXPENSES

The Company's other operating expenses consist of the following amounts:

7. FINANCE COSTS AND INCOME

The Company's finance costs consist of the following amounts:

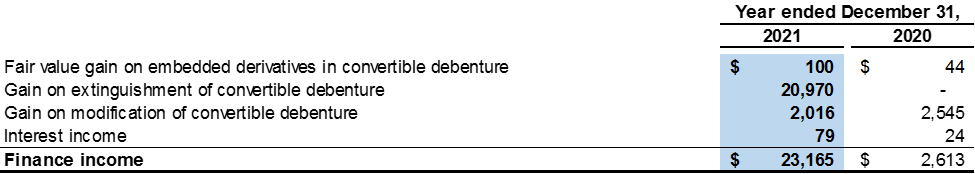

7. FINANCE COSTS AND INCOME (CONTINUED)

The Company's finance income consists of the following amounts:

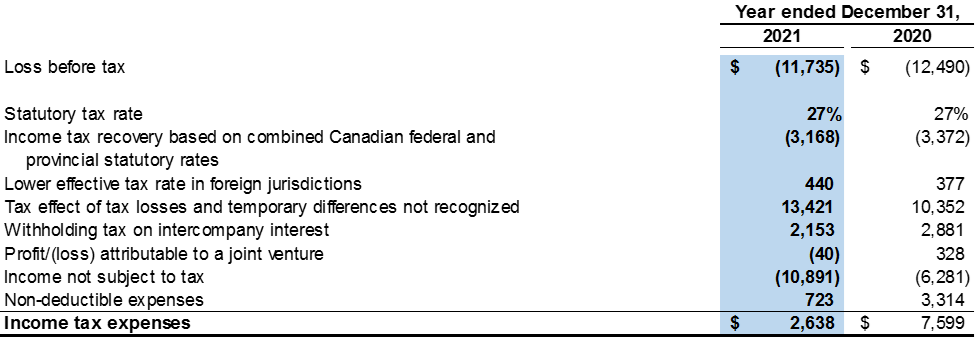

8. TAXES

8.1 Income tax recognized in profit or loss

The Canadian statutory tax rate was 27% (2020: 27%). A reconciliation between the Company's tax expense and the product of the Company's loss before tax multiplied by the Company's domestic tax rate is as follows:

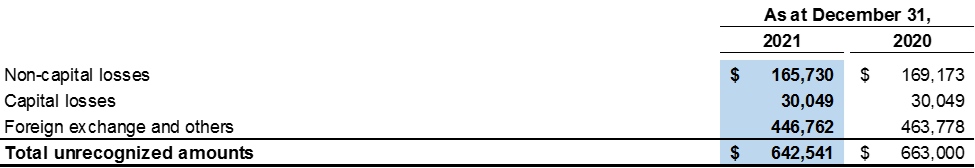

8.2 Unrecognized deductible temporary differences and unused tax losses

The Company's deductible temporary differences and unused tax losses for which no deferred tax asset is recognized consist of the following amounts:

8.3 Expiry dates

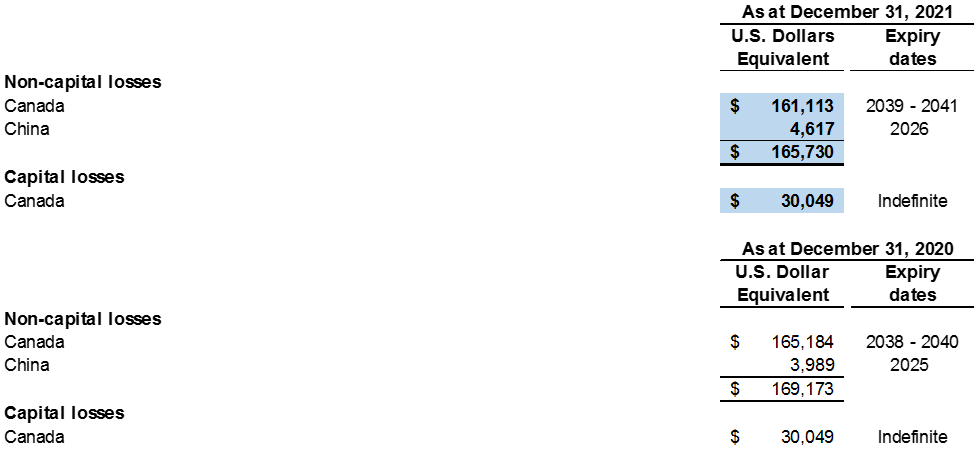

The expiry dates of the Company's unused tax losses are as follows:

9. LOSS PER SHARE

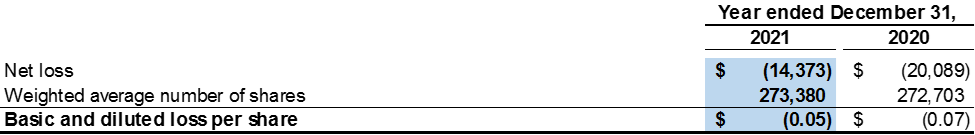

The calculation of basic and diluted loss per share is based on the following data:

Potentially dilutive items not included in the calculation of diluted earnings per share for the year ended December 31, 2021 include the underlying shares comprised in the convertible debenture and stock options that were anti-dilutive.

10. TRADE AND OTHER RECEIVABLES

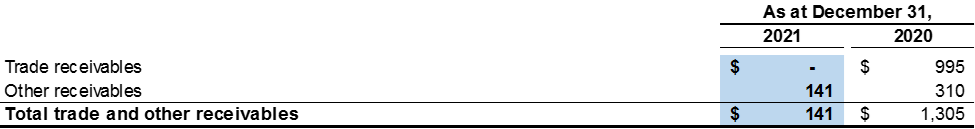

The Company's trade and other receivables consist of the following amounts:

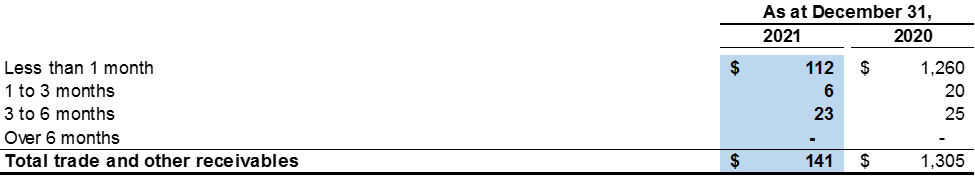

The aging of the Company's trade and other receivables, based on invoice date and net of provisions, is as follows:

Overdue balances are reviewed regularly by senior management. The Company does not hold any collateral or other credit enhancements over its trade and other receivable balances.

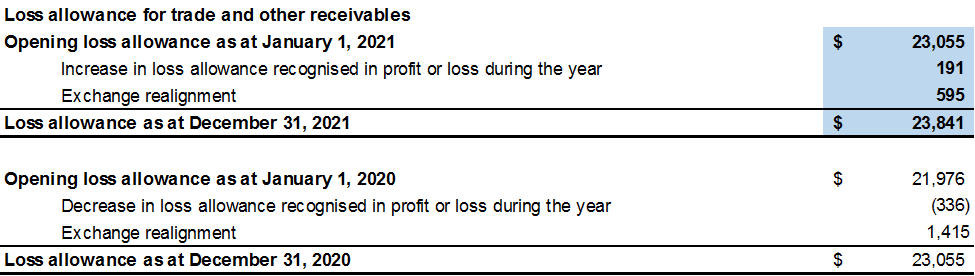

The Company has determined that the loss allowance on its trade and other receivables was $23,841 (December 31, 2020: $23,055) as at December 31, 2021, based upon an expected loss rate of 10% for trade and other receivables 90 days past due and 100% for trade and other receivables 180 days past due. The closing allowances for trade and other receivables as at December 31, 2021 reconcile to the opening loss allowances as follows:

11. TRADE AND OTHER PAYABLES

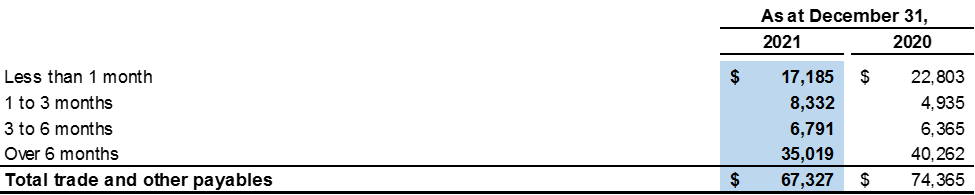

Trade and other payables of the Company primarily consist of amounts outstanding for trade purchases relating to coal mining, development and exploration activities and mining royalties payable. The usual credit period taken for trade purchases is between 30 to 90 days.

The aging of the Company's trade and other payables, based on invoice date, is as follows:

The trade and other payables of $67,327 (2020: $74,365) included the income tax payable $3,682 (2020: $4,365) and other tax payables of $22,075 (2020: $31,742).

12. DEFERRED REVENUE

At December 31, 2021, the Company had deferred revenue of $26,477, which represents cash prepayments from customers for future coal sales (2020: $20,831).

The movement of the Company's deferred revenue is as follows:

The performance obligation related to the revenue from customers for contracts that are unsatisfied (or partially unsatisfied) are expected to be recognized within one year after the reporting date. The Company applies the practical expedient and does not disclose information about any remaining performance obligation that is a part of contract that has original expected duration of one year or less.

13. INTEREST-BEARING BORROWING

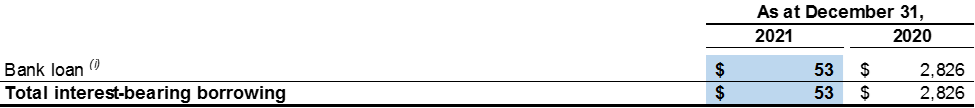

The Company's interest-bearing borrowing consists of the following amounts:

(i) Bank Loan

In February 2021, $2,826 was repaid to a Mongolian bank by the Company in full settlement of the outstanding principal balance of the bank loan obtained in 2018 and the accrued interest thereon.

On December 30, 2021, SGS obtained a bank loan (the ‘2021 Bank Loan") in the principal amount of $53 from a Mongolian bank with the key commercial terms as follows

- Maturity date set at 3 months from drawdown;

- Interest rate of 16% per annum and interest is payable at the maturity date; and

- One item of property, plant and equipment was pledged as security for the 2021 Bank Loan. As at December 31, 2021, the net book value of the pledged item of property, plant and equipment was $nil.

As at December 31, 2021, the outstanding principal balance for the 2021 Bank Loan was $53 and the Company owed accrued interest of $nil.

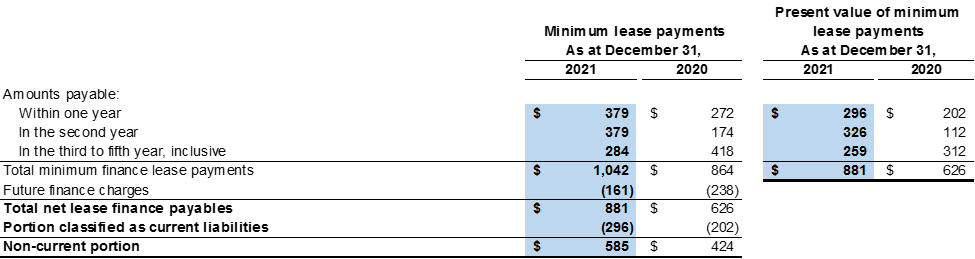

14. LEASE LIABILITIES

The Company leases certain of its office premises for daily operations. These leases have remaining lease terms ranging from 1 to 5 years.

At December 31, 2021, the total future minimum lease payments and their present values were as follows:

15. CONVERTIBLE DEBENTURE

On November 19, 2009, the Company issued a convertible debenture to a wholly owned subsidiary of CIC for $500,000.

The convertible debenture is presented as a liability since it contains no equity components. The convertible debenture is a hybrid instrument, containing a debt host component and three embedded derivatives - the investor's conversion option, the issuer's conversion option and the equity based interest payment provision (the 1.6% share interest payment) (the "embedded derivatives"). The debt host component is classified as other-financial-liabilities and is measured at amortized cost using the effective interest rate method and the embedded derivatives are classified as fair value through profit or loss and all changes in fair value are recorded in profit or loss. The difference between the debt host component and the principal amount of the loan outstanding is accreted to profit or loss over the expected life of the convertible debenture.

The embedded derivatives were valued upon initial measurement and subsequent periods using a Monte Carlo simulation valuation model. A Monte Carlo simulation model is a valuation model that relies on random sampling and is often used when modeling systems with a large number of inputs and where there is significant uncertainty in the future value of inputs and where the movement of the inputs can be independent of each other. Some of the key inputs used by the Company in its Monte Carlo simulation include: the floor and ceiling conversion prices, the Company's common share price, the risk-free rate of return, expected volatility of the Company's common share price, forward foreign exchange rate curves (between the CAD$ and U.S. dollar) and spot foreign exchange rates.

15.1 Partial conversion

On March 29, 2010, the Company exercised a right within the debenture to call and convert $250,000 of the debenture for 21,471 Common Shares.

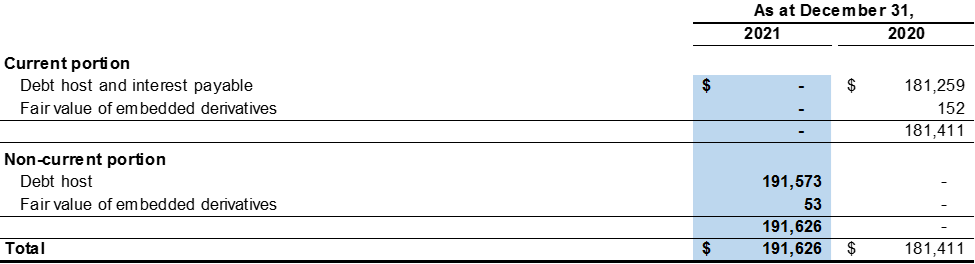

15.2 Presentation

Based on the Company's valuation as at December 31, 2021, the fair value of the embedded derivatives decreased by $100 compared to December 31, 2020. The decrease was recorded as finance income for the year ended December 31, 2021.

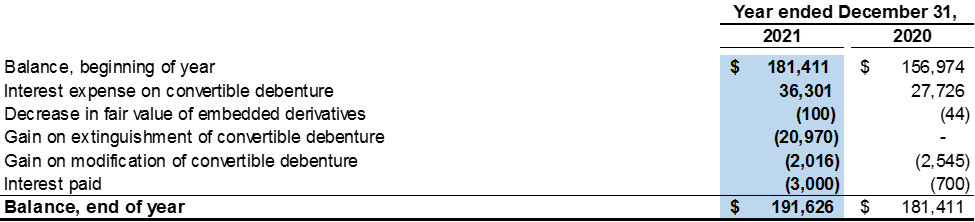

For the year ended December 31, 2021, the Company recorded interest expense of $36,301 related to the convertible debenture as a finance cost (2020: $27,726). The interest expense consists of the interest at the contract rate and the accretion of the debt host component of the convertible debenture. To calculate the accretion expense, the Company uses the contract life of 30 years and an effective interest rate of 22.2%.

A gain on extinguishment of substantially modified terms of $20,970 was recognized in profit or loss for the year ended December 31, 2021 for the difference between the derecognition of original convertible debenture and recognition of the convertible debenture under 2020 November Deferral Agreement discounted at the new effective interest rate.

A modification gain of $2,016 was recognised in profit or loss for the year ended December 31, 2021 (2020: $2,545) for the difference between the original contractual cash flows and modified cash flows under the 2021 July Deferral Agreement discounted at the original effective interest rate.

15. CONVERTIBLE DEBENTURE (CONTINUED)

15.2 Presentation (continued)

The movements of the amounts due under the convertible debenture are as follows:

The convertible debenture balance consists of the following amounts:

16. ACCUMULATED DEFICIT AND DIVIDENDS

At December 31, 2021, the Company has accumulated a deficit of $1,212,071 (2020: $1,197,698). No dividend has been paid or declared by the Company since inception.

The Board did not recommend the payment of any dividend for the year ended December 31, 2021 (2020: nil).

REVIEW OF UNAUDITED RESULTS

The annual results of the Company for the year ended December 31, 2021 were reviewed by the Audit Committee of the Company and approved and authorized for issue by the Board on March 30, 2022.

As a result of the Company's auditor having not been able to obtain sufficient audit evidence to support management's going concern assumptions, the auditing process for the annual results for the year ended December 31, 2021 has not been completed. Following the completion of the audit process, the Company will issue further press release(s) in relation to the audited results for the year ended December 31, 2021 and the material differences (if any) as compared with the annual results contained herein. In addition, the Company will issue further press release as and when necessary if there are other material development in the completion of the audit process.

CANADIAN SECURITIES LAW DISCLOSURE

As noted above, the Company is postponing the filing of the 2021 Annual Filings as a result of the Auditors being unable to complete the audit process for the Company's annual results for the year ended 2021 prior to the filing deadline for the 2021 Annual Filings of March 30, 2022.

On March 17, 2022, the Company made an application to the BCSC requesting that a MCTO be granted in respect of the late filing of the 2021 Annual Filings. As of March 30, 2022, the BCSC has not issued a decision in respect of the Company's MCTO application. There is no guarantee that a MCTO will be granted. For more information on the potential outcome of the BCSC's decision to either grant or refuse to grant the MCTO, see "Management Cease Trade Order" above.

Until such time as the Company files its 2021 Annual Filings, shareholders and potential investors of the Company are advised to exercise caution when dealing in the securities of the Company.

QUALIFIED PERSONS

Disclosure of a scientific or technical nature in respect of the Company's material mineral project, the Ovoot Tolgoi Mine, was prepared by or under the supervision of the individuals set out in the table below, each of whom is a "Qualified Person" as that term is defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators: